NO spanish version below! (Translation: Lo sé, lo sé. La semana pasada os prometí la vuelta a la versión española, pero la gran acogida de la última publicación, exclusivamente en inglés, y el hecho de que tener solo una versión del artículo me ahorra la mitad del tiempo -no os hacéis una idea de lo coñ** que me resulta traducir- me ha hecho optar por hacer otro número exclusivamente en inglés para ver los resultados. Si, mi querido lector, esto te supone una gran importunidad, no dudes en transmitirmelo y trabajaré para que en el próximo número dispongas de tu versión en español).

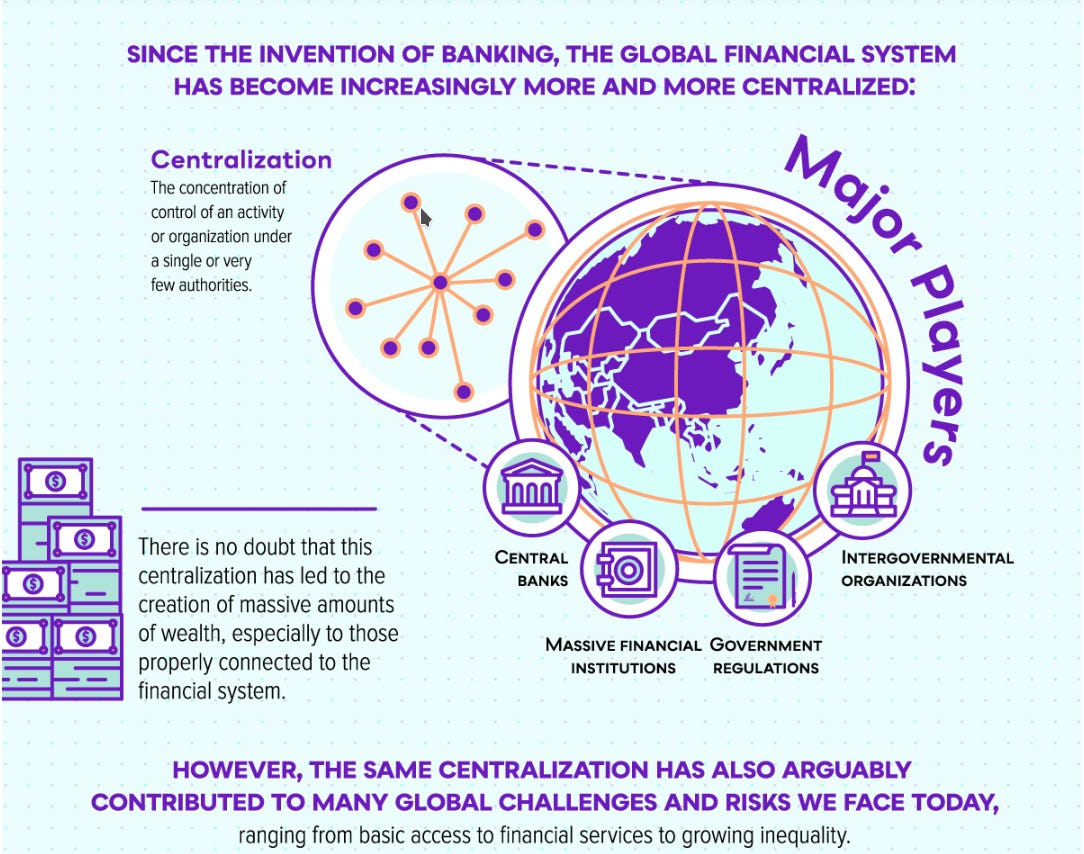

Since I read for the first time Libra’s whitepaper, there has been a concept that has been resonating in me ever since: Decentralized Finance (DeFi). I have always been certain that blockchain technology and decentralization would change the Internet as we know it, fixing some of its current flaws and inefficiencies (more on this in future publications). What I have been overlooking until recently is that before the Internet is disrupted by blockchain and decentralization, the all-powerful system that can be overthrown by this technology is the financial one. And this will be all thanks to the concept of DeFi.

I know, I know. The first thing that comes to your mind when I talk about decentralized finance are cryptocurrencies. This also happened to me till recently. I reneged on the concept of DeFi thinking that this was all about crypto-opportunists, trading, and getting-rich-fast initiatives. But that was until I started understanding the rationale behind initiatives such as Libra, I found the DeFi community, and I got to know DeFi-related projects with clear views to fix existing problems in the financial sector. It was then when I realized the power behind these projects, and how it is a previous stage for the “new Internet”.

The DeFi-nition

So what do we mean with DeFi? There are a lot of definitions out there of DeFi (depending on your level of decentralization maximalist, crypto-anarchist or corporate bitch). I will share what DeFi is for me.

One of the main of flaws of the current Internet is that it is becoming increasingly centralized, with all its undesired consequences. The same happens with the financial sector. Thus, DeFi is an attempt to build a decentralized financial system removing all the unnecessary middlemen and inefficiencies. By building a decentralized infrastructure for finance, what it is intended is to achieve a system with the following features (Disclaimer: this is a homemade list, in other references you may find slightly different versions of this list):

Open: Or how some people in the blockchain ecosystem like to name this property, permisionless. The aim for DeFi is to allow anyone to use global financial services without barriers. On the one hand, anyone with a smartphone would be able to access any of the services deployed over a global financial network; on the other, anyone would be able to leverage the network to deploy financial services. I like to think of DeFi as a way of deploying the Internet of Money. Imagine the gamut of possibilities if anyone could deploy or consume financial services or new secondary markets over a global network, just like we do with web apps. This view get me the chills.

Decentralization: The current financial system is centralized, and it also has important entry barriers for newcomers (noup! you can’t launch your own central bank or issue your own currency, even if you are called Facebook). There are already European directives such as PSD2 attempting to reduce the entry barriers to the financial sector, but in spite of the effort, all the power and stake is still centralized. DeFi services will leverage the use of decentralized technologies (blockchain networks, advanced cryptography, decentralized identities for KYC and AML, etc.) to remove the middlemen. By delegating all the trust in the technical infrastructure we are able to remove middlemen, and with it many of the current flaws of the financial sector (such as high fees, inefficiencies, lack of trust in the system, oligopolies, etc.).

Trustless: This property deserves an independent bullet by itself. As already mentioned, DeFi leverages the use of the all-mighty blockchain ,and other decentralized technologies to work. For me, one of the biggest benefits of these technologies is that you don’t need to trust humans (with their flaws, impulses and hidden interests) anymore, but you can trust the maths under the tech. This allows us to do the things we do in DeFi such as removing the middlemen, instant cross-settlements, affordable money savings and international transfers, etc. We don’t need to give a stake to the middlemen anymore. But more about this when we explore some of the DeFi projects.

Transparent: Another of the properties directly inherited by the underlying technologies of DeFi. The use of global decentralized networks shared by everyone offers a strong layer of transparency (and if you are wondering, no, privacy is not an issue, or at least it won’t be in the near future. This matter should be of as much a concern in DeFi as in traditional finance). When services are implemented through smart contracts or distributed logic in a decentralize network, anyone can inspect the contract and predict how the service will behave under any circumstance. No more hidden costs, unpredictable contract clauses, or “last-minute” changes (of course I am assuming anyone could the code of a smart contract. This is a barrier to lower in the use of DeFi when the time comes).

Programmable: And talking about smart contracts, of course, DeFi is programmable. Imagine if you could get into Visa’s network and configure it to do whatever you need it to do for the benefit of your e-commerce service. And that’s just a toy example, think about the tools we are giving economists to manage debt, monetary policies, or simply monitor the economy (what the hell, maybe this is too much for them). Going a little further, with a programmable financial network of this kind things such as “no backing out” rules could be implemented. There could be agreed governing rules so that for a policy to be accepted, as for it to be modified, it has to be conveniently voted by a majority of stakeholders. Poor Trump, his commercial war would have been a nightmare if international tariffs were implemented over a DeFi network.

No downtime, 24x7: The use of a decentralize infrastructure leads to high redundancy in the network, what leads to no central point of failure, and an infrastructure with virtually no downtime. We could technically have 24x7 stock markets with instant settlement, and instant transfers.

Interoperability and co-existence: I am no “decentralization maximalist”, so I understand that the financial system in its entirety may not be possible to be decentralized due to regulatory, state, safety, or economic matters. In any case, the underlaying DeFi technologies would allow to easily coexist with existent traditional system and other DeFi services, offering all the benefits of DeFi, and the promised brand new services, even if part of the system is still centralized (central banks, Visa and related, etc.).

The Projects, and their magic

And you may be thinking: “Ok! Brilliant! But these are just castles in the air, or is there something palpable already?”. And the answer is that there are a lot of projects alredy in the blockchain ecosystem exploring the capabilities of DeFi (let’s have a look at some of my favorite use cases):

Stablecoins: For me stablecoins will be one of the first production developments in the DeFi ecosystem. Stablecoins are cryptocurrencies pegged to other assets (or even algorithms). Stablecoins could be the key for a transition or coexistence between DeFi and traditional finance. Using stablecoins pegged to traditional assets could be a way of elegantly minding the gap between DeFi and Fiat money.

Maker: Maker is the project behind the well-known stablecoin Dai. What maker is trying is to build a financial ecosystem around the stablecoin DAI. The Dai is pegged to the USD so that 1 DAI is always around 1$. The DAI is deployed over the Ethereum network and using DAI Maker also offers services to issue debt or make loans.

Libra: A lot has been written (even by me) about Libra the past following months. Libra is a great example of a global stablecoin issued by a corporation and backed by traditional financial instruments to mind the gap between DeFi and traditional finance (More about Libra in my first number and my technical analysis in Medium). This is a upcoming trend, and we should expect other corporations, financial institutions and even states to issue their own cryptocurrencies and stablecoins in the next few months/year.

Exchanges: Here I am not talking about cryptocurrency exchanges such as Coinbase or Binance, but about exchange protocols, i.e. a technical layer to easily issue tokenized assets and exchange them for other assets (or between networks). These projects could be seen as the pipes of the new global DeFI networks about to come. Right now exchange protocols are focused on digital assets and cryptocurrencies, but in the future they could be the basic infrastructure for the exchange of traditional financial assets.

0x: 0x is an open protocol that enables the peer-to-peer exchange of assets on the Ethereum blockchain.

Kyber Network: Kyber is an on-chain liquidity protocol that aggregates liquidity from a wide range of reserves, powering instant and secure token exchange in any decentralized application.

Derivatives: The same way we have derivative contracts in traditional finance, some projects are also working on issuing options and futures from underlying digital assets and tokens. Once again, these projects are really focused on cryptocurrencies, but the same concepts could be extended in a DeFi approach to traditional financial assets.

dY/dX: Really focused on trading.

Market Protocol: Targeting the issuing of derivatives of digital assets.

bZx: A derivative exchange. With bZx you can go short on Ethereum.

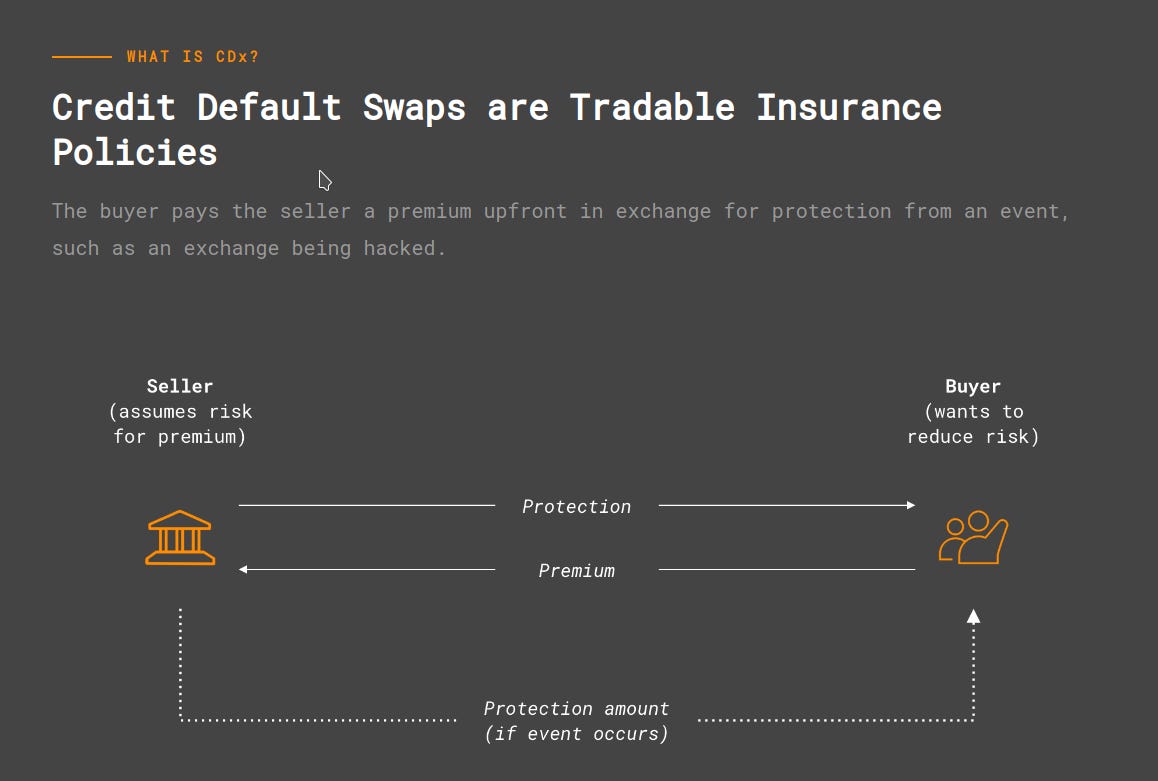

Insurance: What if you could use your owned cryptocurrencies to insure, for instance, a exchange in exchange for a premium? And what if the payment of premiums and coverage in case of events were automatically triggered through a smart contract? This is what projects as CDx are exploring, and if proved successful, their concept could be easily extended to many other industries (apart from cryptocurrencies and exchanges).

Loans: Crowdlending portals have recently gained a lot of popularity. What project as Dharma are trying to do around loans is what crowdlending platforms are doing already but removing the middlemen. In DeFi crowdlending projects, as Dharma, you can ask for a loan or give a loan with an agreed interest rate and conditions. The payments for the loan can even be automated through smart contracts. Imagine how powerful could a platform as this be if we mix it with insurance projects such as CDx.

Dharma: I really encourage you to read Dharma’s blog as it is full of interesting materials, and to have a deep look to how it works

Securities: And how can we have a financial system without equities, funds, fixed income and real estate? There are a lot of projects trying to tokenize these assets and issuing them over decentralize networks and exchange markets to test the benefits of a DeFi approach over traditional markets (lower settlement timesa and costs, higher speeds and efficiencies… you know, the usual).

Securitize: One of the startups (with many others) trying to issue the first financial assets over a decentralize infrastructure compliant with financial regulations.

Other interesting DeFi platforms (I didn’t know where to categorize as they have a really traversal role in the ecosystem).

The Challenges: Not without a fight

I agree with the fact that blockchain technology and decentralization are bound to fix some of the Internet’s current flaws, but before reaching this ambitious goal, we have the chance to train by fixing the financial system. Disrupting the financial system has some important barriers though, mainly regulation and incumbents. The transition from a closed and centralized paradigm to a decentralized and open approach won’t come without a fight. The financial sector is strictly regulated, and incumbents will lobby in an attempt to keep their stake of the financial pie (ask Libra’s experience dealing with regulators).

As we saw in the aforementioned list, current DeFi projects are highly focused and implemented using cryptocurrencies, but this is not necessarily a bad thing. Cryptocurrencies have a lot of well-known drawbacks, but they also serve as a perfect sandbox for tokenization and DeFi projects for regulators to analyze their benefits and risks, start taking away their fear, and begin to implement the future regulations for a global financial system. Even more, we must be optimistic, as a new stage in the development of DeFi is about to come, when corporate and state-backed stablecoins are released, as they will let us start testing DeFi services outside the “misfit” cryptocurrency world.

I already mentioned it in my first article about Libra, decentralize finance is an ambitious goal worth exploring. We have exciting times ahead.

Interesting readings

For those of you as excited with this topic as me, let me share a few interesting references I found while researching about the topic:

An interesting paper “Regulating LIBRA: The Transformative Potential of Facebook’s Cryptocurrency and Possible Regulatory Responses”, and a summary.

Dharma’s Brendan Forster keynote about DeFi at Fluidity Summit 2019.

China is already issuing a cryptocurrency that will be distributed between the biggest banks and tech companies to encourage its mass adoption.

The Official Website of the DeFi.network project, which includes a complete list of interesting DeFi projects (in case you want to check out some of the ones I left out of my list).

Some news about the coexistence of DeFi projects and the traditional system.

Everything with pictures is better

As a bonus, I wanted to share an interesting summary infographic about DeFi as a support to cover concepts I may have left off along the way.